Tompkins County Considers How to Spend $19.8M in American Rescue Plan Funds

SUMMARY

Tompkins County has almost $20 million in American Rescue Plan Funds. The money is meant to get Tompkins County on track to economic recovery from the COVID-19 pandemic, but there are a lot of different strategies to do that.

Th County wants your input on how you think this money can be best used. You can fill out this survey before June 28th to share your thoughts with them.

But first, listen to this interview with Tompkins County Legislator, Deborah Dawson. From her, we learn about the potential uses the Legislature has been exploring for these funds that.

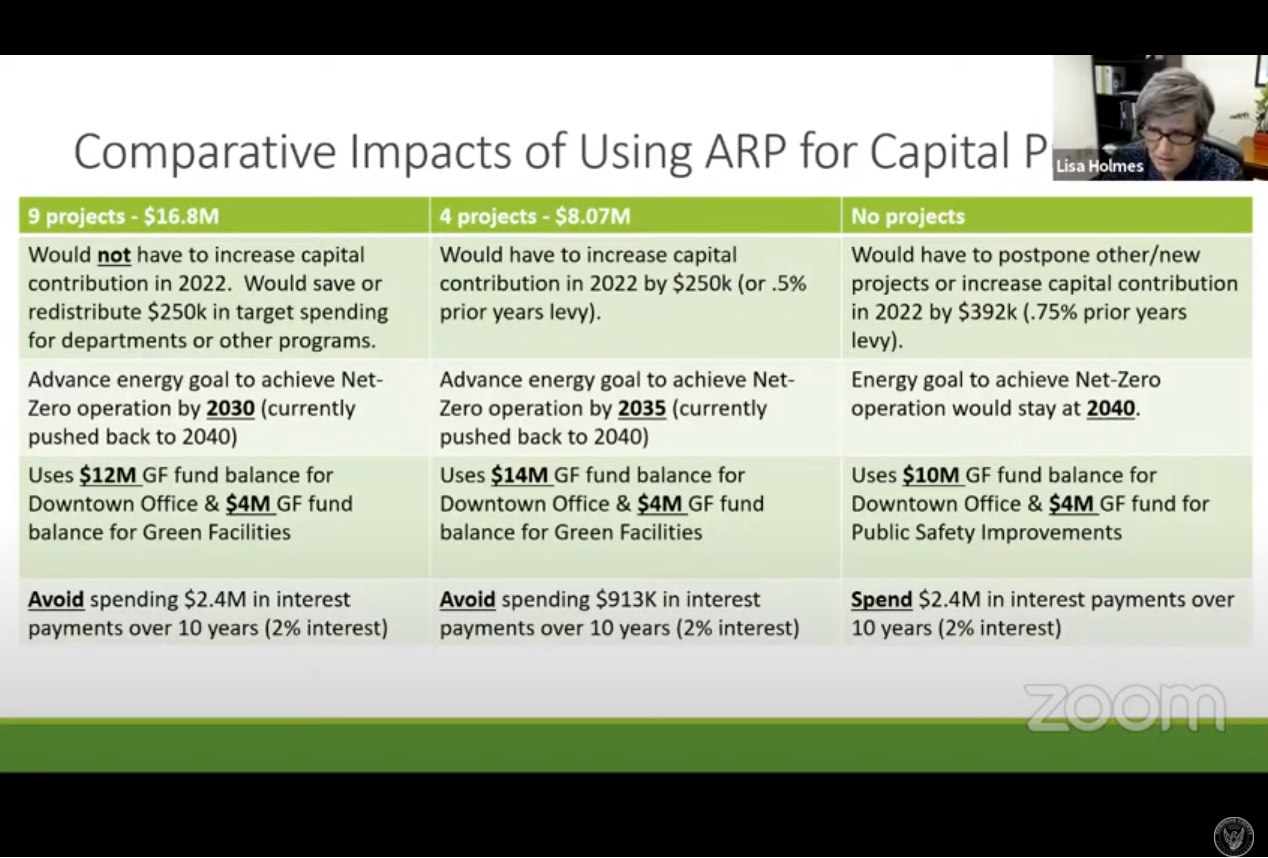

Much of this conversation stems from a presentation given by Interim-County Administrator, Lisa Holmes, at a June 15th Tompkins County Legislature meeting.

You can check that virtual meeting out on the county's YouTube channel.

TRANSCRIPTION

[Jimmy Jordan]: Legislator Dawson, thanks so much for getting on the phone with me.Legislator Dawson, you hail from the county's 10th legislature district and you're Chair of the budget capital and Personnel Committee. We're going to be talking about the funds Tompkins County has received from the American Rescue Plan, and how those funds might be used in the county's recovery from the COVID crisis. A lot of our conversation is going to overlap with a discussion and presentation on these ARP funds that Interim-County Administrator Lisa Holmes gave at a June 15, Tompkins County legislature meeting. Listeners, you can find that virtual meeting on the Tompkins County YouTube channel. There are a number of really interesting ways that this money can be used in the county. And you know, there's opportunity too for public input.

[Deborah Dawson]: Yeah, Jimmy, and I would recommend that if anyone has not yet filled out our survey, they can go to the Tompkins County website. It should be right on that first page, the link to the survey. I'm happy to say that as of this morning, we've already received 1800 or so responses, which is just great input from the public.

[Jimmy Jordan]: And that survey will also be linked on WRFI's website. The last day to submit is just around the corner, June 28th. That's this upcoming Monday. And so now, before we get into what this money could potentially be used for, we should get a few basics down. Legislator Dawson, how much is Tompkins County receiving from the American rescue plan and what was the county's revenue shortfall as a result of COVID?

[Deborah Dawson]: Our revenue loss calculation at this point is somewhere between 21 and $22 million. caucus county is going to be receiving $19,847,267 into equal trenches. We've already received the first tranche and deposited it in an interest bearing account. And we will receive the second tranche a year from when we received the first one, which is early June of next year.

[Jimmy Jordan]: There are a really wide range of things that these ARP funds can be put toward, and there are also some restrictions. Can you tell me about these parameters?

[Deborah Dawson]: Okay, so basically, the ARP Act functionally divides the funds into two different parts, one of which is up to the amount of our revenue loss, we could pretty much use the money for most government operations purposes. So technically, we can use all of the funds for government operations, to the extent that you go beyond what the county lost, or if you want to use it for other statutorily permissible purposes, you can use it to respond to the public health emergency, or to the negative economic impacts. And that includes giving assistance to households, small businesses and nonprofits, to seriously impacted industries like tourism, travel and hospitality. Another use is to respond to workers performing essential work during a public health emergency. But oddly, we can only use it to give to those workers for things that they did after March 3rd, so that doesn't really help all that much with the people who were really on the front lines during the worst of it in 2020. And finally, we can use it to make necessary investments in water, sewer and broadband infrastructure. So those are the statutory purposes.

[Jimmy Jordan]: So a lot of different potential uses for this money. One focus of the conversation in the legislature for how this money could be used was for the county's capital program, and this is a little bit complicated. Can you explain to listeners what the capital program is, and why the county has looked at the option of using up to $16.8 million of the $20 million of ARP funding on the capital program, but what is the good rationale for putting this money towards the capital program?

[Deborah Dawson]: Okay, so you got a lot of questions packed in there, Jimmy.

[Jimmy Jordan]: *Laughs* Sorry.

[Deborah Dawson]: That's alright. The county has a capital plan. There are about $120 million versus capital improvements and upgrades that we're going to be looking at over the next couple of decades. You obviously have to plan for that because there's a lot of money and, yeah, the county has the ability to borrow and bond to that money, but you have to remember that everything you borrow out here has to be paid back. All right. So that's what the capital plan does, but then the question is, why would we invest any of this money in cash for capital? Which is a permissible use under the government operations section of the statute. So, we have to plan to have enough money dedicated to a capital fund so that we can maintain our debt service, even if we suffer economic setbacks like the one we suffered in 2020. So, that's the capital plan. Obviously, we're not doing $120 million of improvements and maintenance in one year. But, you know, we're looking at some fairly big investments. And what we do generally and have done for years is put aside, you know, $250,000, at least of our levee every year into that capital funds to build up that fund so that we know that we can cover our debt service. And here's a big piece of the rationale for that the money that we're getting from ARPA is like one time money. So you can't use one time money for ongoing expenses. So for example, we can't -- we could, but we'd be setting ourselves up for fiscal failure. If we did -- If we said, okay, we're going to add 60 new employees, and it's going to cost 5 million extra dollars a year -- these are just numbers, I'm pulling out my ear (they're not realistic but) -- So we're going to dedicate another $5 million a year to hiring these new people. Well, once the ARPA money runs out after two years how do we pay that $5 million a year? We'd have to pull it out of the levee, or our sales tax revenue. And that would put a lot of pressure on our budget, and prevent us from dealing with other needs that might arise. And also it would increase the need to increase property taxes, for example. However, if you take that money, and you use it as cash for capital, you've reduced the amount of money every year that you have to use for debt service. So in the example that Lisa Holmes gave us on the 15th, if we invested $16.8 million in this money in cash for capital, that would reduce our annual debt service obligation by $1.6 million. Now, that's $1.6 million, that we can use every year for the next ten, fifteen, twenty years to meet ongoing needs in county government. So that's the benefit of the cash or capital option. I want to say at this point that although I personally am very much in favor of using a big chunk of this as cash for capital, for the reason that it would free up our budget for years to come, there are many people on the legislature who want to see us distribute a larger chunk of this money to individuals, businesses, not-for-profits in the community. And the reason they want to do that, in paying a question I know you're going to ask is that this money is not subject to the usual restrictions of New York State law that prohibits us from giving county funds to businesses and individuals.

[Jimmy Jordan]: That was a question I was gonna ask. So, is there anything more to explained about how the the ARP funding is more flexible in its use? Like what can't the county use funds raised through local property taxes on that the ARP funding can be used for?

[Deborah Dawson]: They call it gifting, you can't give a private individual or business direct assistance, because that's considered a gift of public money to a private individual. The ARP funds are not money that we've levied from our taxpayers or collected and sales tax, so they're not subject to that restriction. That's the most significant difference, I think. And that's, of course, a reason why many of my colleagues want to take advantage of the opportunity to help the larger community, because we've all suffered a lot of losses. So, I just want to be sure I'm sorting out my personal preferences from other legislators preferences, and then that the listening audience understands that these decisions have not been made yet by the legislature.

[Jimmy Jordan]: Okay, so I'm just going to put a pin in the capital program thread that we were running, and I just want to ask you now, what are the sorts of other projects you know, public investments, that have been considered on the Legislature for the funding received from the American Rescue Plan?

[Deborah Dawson]: Well, we haven't really started our deliberations on this. We're having a meeting of what we call the expanded Budget Committee on Wednesday, June 30th, at 5:30pm. The expanded budget committees is a committee of the whole. So, everyone in the legislature is part of that, and that's when we'll start our discussions.

I know that we have heard from our local tourism and hospitality businesses that they're in a bad way. I know restaurants here are suffering. I know that one of the problems that the business community is facing not just here, but she can read it in the Wall Street Journal or the New York Times every day, is that it's hard for businesses to find people who are willing to take certain jobs, especially the lower end jobs in industries like restaurants, and tourism. I don't know honestly, how the county's infusion of funds in those industries would really help them. I mean, I personally think that maybe part of the problem is that people across the board now after the pandemic are kind of less willing to work for lower wages. I don't know how you solve the problem with a one time infusion of money. I know that last week in our budget, capital and personnel meeting, and today in the Housing and Economic Development Committee, we did pass a resolution that will go to the legislature soon to move $573,000 funds from our contingent funds over to our Convention and Visitors Bureau and our Strategic Tourism Planning Board to fund our outreach and advertising efforts to promote Ithaca and Tompkins County as a vacation destination this year, because that will help enormously. But that's separate and apart from from the art funds. Another potential area where we could possibly make a big difference is to provide some capital funding for the development of new childcare facilities because we have a severe childcare shortage -- a shortage of providers in our area. We had that before the pandemic and it's it hasn't gotten any better. So that's another potential use.

[Jimmy Jordan]: Can you tell me a little bit more about that shortage? I do have a note here, and I really wanted to ask you about it. So I'm glad you brought it up. Like how bad is of a problem in Tompkins County?

[Deborah Dawson]: Well, this morning Sue Dale-Hall was reporting on the problem and she mentioned, you know, based on the number of children in the county versus the number of spaces for childcare, we only have space through one out of four, or one out of three, depending on the age of the child because the state regulations governing the ratio of caregivers to children's varies depending on whether they're infants, I think under two versus other children.

[Jimmy Jordan]: Those are some potential ways that this funding can be used, I'm going to take us back to the capital program and what that investment can look like the upshot of that course of action of using the American rescue plan funding on the capital program is that the lost revenue that we saw as a result of COVID in Tompkins County, could be made up for over the next 10 years. Right?

[Deborah Dawson]: Well, yeah, that would be practical, except instead of hearing this, you know, one time only big chunk of money fall in our laps, we can stretch it out into a smaller annual boost in the form of that much less debt service that we have to deal with.

[Jimmy Jordan]: And so I'm wondering, you know, Tompkins County had this revenue shortfall. And so what is the consequence of not using a large portion of the ARP funding to address that?

[Deborah Dawson]: Well, I mean, we're gonna have to make it up somewhere else. We actually didn't do too badly. We didn't do as badly as we thought we would do. In no small part because of the efforts of Jason Molino and other people on our staff, including Lisa and Amy Hendrix. You know, they came up proactively with plans to offer early retirement incentives and we eliminated 47 positions.

We didn't have to fire anybody because we were able to move anyone who wanted to be moved into unfilled positions, if they were willing to go. But what that ended up doing is reducing our overall workforce in terms of the positions that we had slated by 6%. And then we lost 41 employees to early retirements. So, you know, in essence, we lost not only institutional knowledge, but with that 6% reduction in workforce, we're just asking fewer people to do the same amount, if not more, work. That's not sustainable over the long term. So, somewhere in this mix we're going to have to find this financial wherewithal to replace lost capacity in the form of workforce, that may not necessarily be exactly the same people doing the same jobs, but we are going to need more people to come on board. And that, again, is one of those expensive that's ongoing.

Another piece of this, as you know, is that what people -- it's harder to hire people now. And one of the things that we're seeing in the county, as we try to replace some of these people that we very much need, is that our current salary structure isn't competitive. So we're having more and more difficult time finding new hires. And so one of the things I think we're gonna have to do in the years ahead, is do a compensation study, and perhaps readjust our compensation schedule to make us a competitive employer. And that's going to be a big expense, it's going to be ongoing. I mean, right now, I think somewhere around $65 million of our $200 million approximately annual budget is salaries, wages and fringe benefits. That's a big chunk.

[Jimmy Jordan]: And you're saying it has to grow?

[Deborah Dawson]: Yeah, you know, there's a lot of moving parts, to trying to figure out what's the best thing to do, you know, we just finished establishing the Community Justice Center and agreeing on what our plans going forward are for Reimagining Public S afety. That won't be cheap, either.

[Jimmy Jordan]: And so that is also another potential place to put this money.

[Deborah Dawson]: Yes, sir.

[Jimmy Jordan]: Like what you were saying before was, you know, it makes sense to use the ARP funding for one time payments, right? In the Capital Project, and rather not for ongoing payments, which would be trickier -- using that money to address staffing problems.

[Deborah Dawson]: Right.

[Jimmy Jordan]: And so the Reimagining Public Safety expenses -- you know, there are people that you're going to be paying for staffing, but there are also one time payments associated with that that would make sense for the funding to be used for

[Deborah Dawson]: Very possibly, yes.

[Jimmy Jordan]: Are there any other big projects like the capital program that would make sense for these one time cash payments to be used for?

[Deborah Dawson]: You know, there probably are, Jimmy, but nothing just pops into my mind right at the moment. There's tons of need out there for many, many things. And that's the problem, you know, people get really excited because it's like $19 million. And I keep saying it's only $19 million. So it's gotta be careful here.

[Jimmy Jordan]: So I think this might be a good time to call listeners to give their feedback, their input to the county. If you're listening to this right now. Legislator Dawson, how can someone let the county government know how they think this money could go to good use?

[Deborah Dawson]: Well, there's always the survey. You know, I really encourage as many people as possible to fill out the survey, I suspect, given what I'm hearing from my colleagues on the legislature, that at some point after this meeting on June 30th, we will probably have a public forum.

People just need to keep their eyes open for notices that. If you don't want to fill out a survey, you're you can always send an email to the legislature. We hear from constituents all the time, we're happy to hear from constituents. I think that in many ways how we use this money is going to be one of the most significantly impactful decisions that we make. I can't promise you that if you write or fill in the survey, we're going to do what you want us to do, but we certainly will take it under careful consideration. Please trust that we're trying our best to make the most strategic and helpful use of this money. I mean, I don't want to look back in 10 years and say "Where the $90 million go and what did we accomplish with it?"

[Jimmy Jordan]: Well, thank you so much for getting on the phone and speaking with me. You've been listening to Tompkins County legislator, Deborah Dawson, Chair of the Budget Capital and Personnel Committee, and we've been talking about the way the American rescue plan funds at Tompkins County has received could potentially be used to recover from the economic impacts of the COVID-19 pandemic.

[Deborah Dawson]: Thanks, Jimmy.